2025 brought employers a rude awakening. Health-benefit costs are surging, and not because of old, predictable categories. Inflation, medical trend, and rising utilization all play a role, but the real increase comes from specialty drugs, advanced therapies, and rising demand across chronic and behavioral conditions. If you manage a benefits plan, you can expect an overall cost trend of 7–9%, and in many cases even higher if you do not act.

This isn’t a temporary shock. It’s a structural shift. For employers planning 2026 renewals and beyond, the question isn’t whether costs go up, but how much they go up. The organizations that get ahead will stop chasing point solutions and start building clinical, data-driven strategies.

In this post, we cover the five conditions hitting employer-sponsored plans hardest and why they matter.

Why Employer Claims Costs Are Rising in 2025

Macro Trends That No CFO Can Ignore

- Pharmacy spend is rising fast. According to a major 2025 employer-benefits survey, average family plan premiums reached $26,993, a 6% rise over 2024.

- Medical cost trends remain elevated. Insurers and actuaries project group-market medical cost trends at 7.5 to 8.5% for 2025 and 2026.

- Specialty drugs and new therapies are eating a larger share of spend. Rising use of advanced medications, including GLP-1s, is reshaping what “typical pharmacy spend” looks like.

- Behavioral health, chronic disease, and complex conditions are growing, both in prevalence and cost per case.

Taken together, these shifts force a new reality. The “average per-employee cost” no longer follows historical linear trends. A small group of high-cost claimants and high-cost therapies now dominate plan spend. As one 2025 industry survey notes, for 2026 employers expect a median cost increase of around 9% if they don’t adjust.

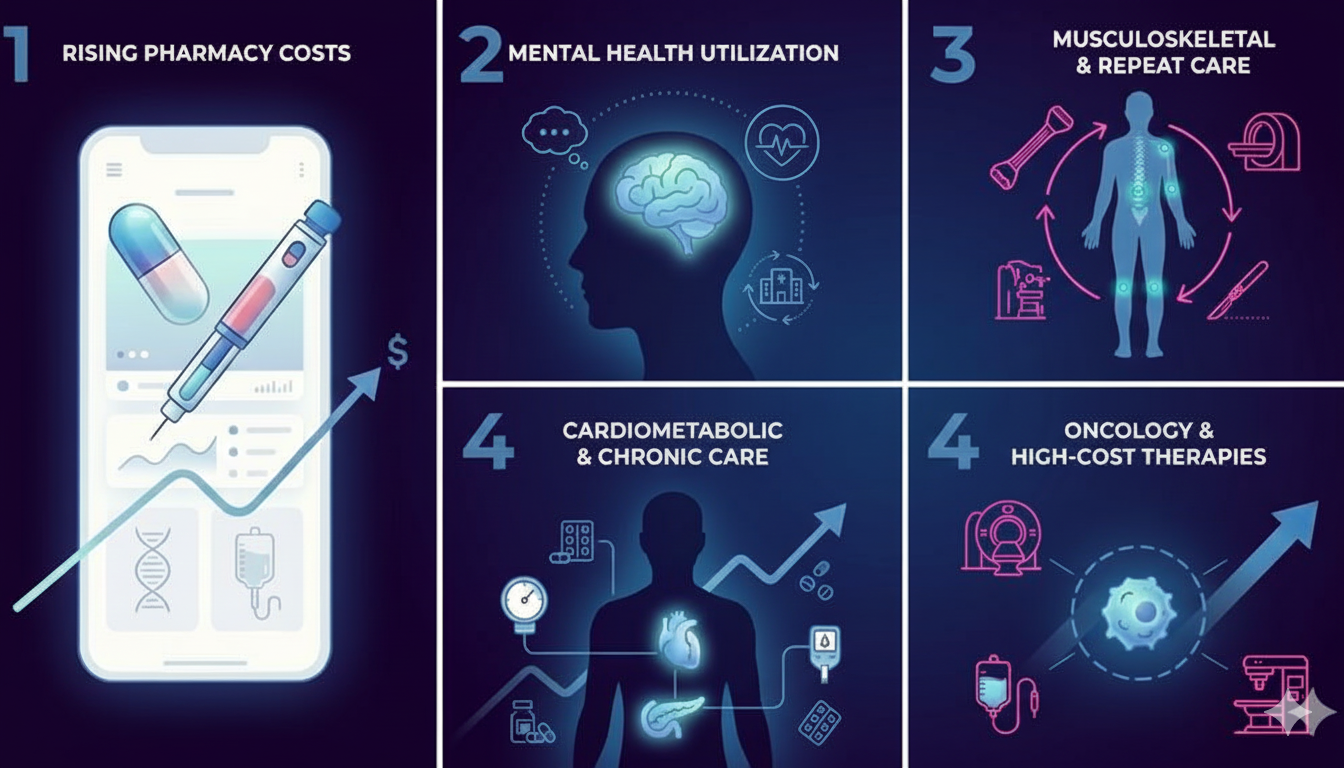

The Top 5 Conditions Driving Employer Claims Costs in 2025

Below are the five conditions and categories that most frequently top employer cost-driver lists in 2025, along with what they cost and how to fight back.

1. Specialty Drugs & GLP-1 Utilization

What’s happening

- New therapies, including GLP-1 weight-loss and diabetes drugs, advanced biologics, and other specialty medications, are becoming widespread. The use of GLP-1 receptor agonists has surged so sharply that many employers now list them among their top cost drivers.

- Pharmacy costs (drugs + specialty meds) are now a much larger component of total spend. For many plans, pharmacy constitutes 25–30% (or more) of overall spend, having grown substantially in recent years.

- According to a recent analysis, GLP-1 and other high-cost medications are not only increasing drug spend, they are also reshaping utilization patterns and long-term liability.

Why it matters (for employers)

- These are not one-time costs: many of these therapies require long-term commitment and recurring claims.

- The ROI on elective prescriptions such as GLP-1s for weight loss is uncertain. Discontinuation rates are high, weight regain is common, and long-term gains often do not offset the cost.

- If not managed, pharmacy spend alone can blow your budget.

Specialty Medications: Cost Mechanics Employers Should Know

This table breaks down how specialty drugs, including GLP-1s and advanced therapies, drive pharmacies through high prices, repeat utilization, and limited controls.

2. Behavioral Health & Substance Use

What’s happening

- As care access expands through in-person and telehealth options, utilization of behavioral health services such as therapy, psychiatry, and substance use treatment has increased sharply.

- Employers report behavioral health as a top condition driving 2025 cost increases, with notable overlap between behavioral health and other chronic or complex conditions that add to medical spend.

Why it matters

- Behavioral health often leads to comorbidities — untreated or poorly managed mental health can exacerbate chronic physical conditions, increasing overall claims.

- Inpatient stays, relapses, or repeated therapy cycles can generate high costs.

Behavioral Health: Cost Drivers Employers Can’t Ignore

This table shows how rising behavioral health utilization increases both direct mental-health costs and downstream medical claims across other conditions.

3. Musculoskeletal Conditions (MSK — back, joints, chronic pain)

What’s happening

- MSK issues remain one of the most common causes of chronic pain, disability, lost productivity, repeated outpatient visits, imaging, injections, PT, and surgeries.

- As people age and as more workers remain in the workforce longer, MSK prevalence rises, pushing these conditions among the top cost drivers for medical spend. While public data linking MSK-specific 2025 spending is still fragmented, its inclusion in chronic-condition and high-cost claim categories is leading many employers to flag MSK as a priority focus.

Why it matters

- MSK claims tend to be recurrent. Imaging, therapy, follow-up, and sometimes surgeries each add cost.

- Long-term MSK issues often lead to disability leaves, reducing productivity and increasing indirect workforce cost.

- Without early intervention, MSK management tends to gravitate toward invasive and high-cost care (e.g. surgeries), inflating claims.

Musculoskeletal Conditions: High Frequency, High Cost

This table explains why common MSK issues lead to repeated claims, disability leaves, and escalating medical and productivity costs for employers.

4. Cardiometabolic Disease (Diabetes, Obesity-Related Conditions, Heart Disease)

What’s happening

- Chronic cardiometabolic conditions remain widespread in working populations: diabetes, hypertension, obesity-related comorbidities, and early-onset cardiovascular risks.

- Combined with the rising use of weight-loss medications (GLP-1s), there’s higher demand for chronic-disease management, outpatient care, medication, and in some cases, catastrophic care for complications.

- Since chronic disease care is long-term and often lifelong, cost accumulation is gradual but persistent.

Why it matters

- Recurrent outpatient visits, continual medication, periodic diagnostics, and risk of acute events (heart attacks, hospitalizations) keeps employer liability high.

- Preventive care gaps or inconsistent adherence amplify long-term risk, increasing future costs.

- Employers paying blindly for coverage without active disease-management strategies often see cost drift compounding over years.

Cardiometabolic Disease: The Long-Tail Cost Problem

This table highlights how chronic cardiometabolic conditions create continuous medical spend and raise the risk of costly downstream events.

5. Cancer and Other Complex Chronic Conditions

What’s happening

- Oncology care, including diagnostics, precision medicine, infusions, outpatient facility services, and long-term treatments, continues to be among the highest-cost categories.

- Employers repeatedly cite cancer as a top condition driving cost increases year after year.

- As treatment moves increasingly to outpatient and precision-medicine settings, costs per claim have surged. These are often unpredictable, high-severity events.

Why it matters

- Single events can cost hundreds of thousands or more. Even a handful of cancer patients can drive a large portion of annual medical spend.

- Because incidence is low but severity is high, costs are difficult to manage, and the financial risk to employers remains substantial.

Without proper care pathways and vendor partnerships, employers can get hit by unchecked claim variability and catastrophic spend.

Cancer Care: Low Volume, High Financial Impact

This table outlines why a small number of cancer and complex chronic cases can drive outsized claims costs and budget volatility.

The Financial Impact: What This Means for Budgets

Let’s put numbers around it.

- According to a 2025 employer benefits survey, average family plan premiums rose 6%, pushing annual family coverage costs near $27,000.

- Without intervention, many employers expect healthcare spend to continue rising — 8–9% per year for 2025 and 2026.

- Given that high-cost claimants and high-cost therapies (specialty drugs, oncology, etc.) contribute a disproportionate share of spend, even a small number of claims can significantly sway plan liability.

For a mid-size employer, a handful of high-cost cases — a few chronic-disease patients, some specialty-drug users, and one or two complex-care cases — can effectively consume the entire year’s budget overrun margin.

Conclusion

Health costs in 2025 aren’t rising by accident. A small number of health problems are driving most employer claims. These include specialty drugs, long-term illnesses, mental health needs, muscle and joint pain, and complex treatments that now happen in more expensive settings. Employers who ignore these patterns will keep seeing higher bills year after year.

The idea behind Top 5 Conditions Driving Employer Claims Costs in 2025 is simple. Costs grow when care isn’t guided early. Pharmacy use, repeated treatments, and delayed care add up fast. When employers improve access, guide people to the right care, and track results, many of these costs can be reduced.

In the upcoming articles, we will take a deeper look at practical ways employers can control these costs and apply these strategies effectively.

Source: